EOB Check Matching Technology and Payment Processing Efficiency

Processing Physician Practice Group payments from multiple PM Systems and Clearinghouses to a single Tax ID/EIN requires a high degree of data accuracy and verification. The distribution of funds for separate divisions (or business units) also adds complexity to the work for MSOs and DSOs. To accomplish this, ReMedics utilizes Business Process Automation (BPA) to create workflow efficiencies and faster turnaround times. One of the many tasks being automated by our proprietary technology is Check Matching, an essential component to accurate payment posting and reconciliation.

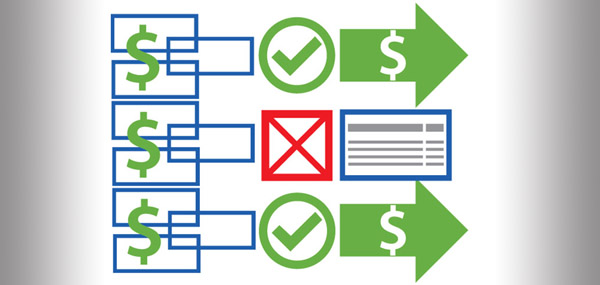

Minimizing Posting Exceptions & Kick Outs

ReMedics uses a series of validation rules that continually look for a Check to match the EOBs being received from the Clearinghouse. When a Check is matched to an EOB by the insurance (payor), check date, check amount and check number, the payment can then be posted through the client’s Practice Management (PM) billing application. This minimizes posting exceptions & kick outs. Unmatched Reports and Exception Worklists, updated daily, provide visibility to any payments that have not been posted, due to either missing the EOB (to provide the patient information) or unmatched deposits. Kept to a minimum as much as possible, these transactions may require manual intervention and/or exception processing.

Capturing All Payments the Key to Efficiency

AR efficiency starts with accurate data and image capture for all types of payments, including co-mingled and non-835 EDI transactions. Having a business partner with the right technology solutions to automate your remittance processing with a Single Cash Management System can help to make your organization more efficient, profitable and ready for growth.

Talk to ReMedics about Check Matching automation and your healthcare organization’s Payment Processing needs. Contact us online — or call 440-671-7700.